How to control costs in accordance with the best business practices

Project costs management is an important element for most managers, no matter which hierarchical level is concerned. This statement could be quite surprising. As a matter of fact, amongst all management sciences, accountancy is certainly one of the most foreseeable and well-structured, not to mention the fact that accountants are known for their thoroughness.

But project cost management requires more than merely putting into practice accountancy rules which have been created in order to determine costs that have been gained during a period in the past, and that accountants compare with costs that have been budgeted for the same period. When it comes to the most usual operations, budget heading related to costs is quite stable. But when it comes to project management, it is different: costs that are needed in order to produce the deliverables of any project are quite often volatile and can significantly vary with the complexity of these deliverables.

Setting up initial budget

The precision and the quality of the budget that is needed in order to produce all deliverables mostly depend on two factors:

- How close people are with the knowledge of functional specifications related to the deliverables?

- To what extent can the costs related to the achievement of the activities be evaluated?

Any lack of knowledge in terms of functional specification or any difficulty in evaluating the efforts needed to achieve the deliverables in accordance with these specifications will make budgeting more difficult.

Projects play a leading role in enhancing the value of your organization as they ensure that it remains competitive and thereby survives. As a result, managers tend to capitalize financial resources in investment programmes dedicated to achieving projects that give an added value to the organization. Because they need to create deliverables that give an added value within a short period of time, managers often tend to speed up the beginning of the activities, even if the deliverables have not yet been completely designed and even if the efforts that are needed in order to achieve them have not yet been defined.

By doing so, they quickly move towards projects delivery phase with an initial budget that allows the project manager to incur costs, whereas a dangerous risk may precisely arise from the fact that these costs exceed.

From initial budget to revised budget

Starting a project when the expected quality and functionality of deliverables have not yet been defined in an accurate way could create issues concerning the achievement of these deliverables. Most of the time, it appears that financial resources that have been allocated in order to feed into the initial budget are not sufficient to achieve revised and improved versions of the deliverables.

On the other hand, it often occurs that estimated financial resources turn out to be insufficient even when deliverables are defined in an accurate way. This can happen for several reasons: insufficient workload, unforeseen technological constraints, higher prices of materials, and so on…

It is thus the project manager’s duty to ensure that the organization can finance these unexpected costs by revising the initial budget. To do so, he has to ask the competent authorities for a review process in order to transform the initial budget into several versions of a revised budget.

Financial review process

This being said, if this process is not part of a transparent governance framework, then review processes will arise from all sides and will overshoot the revised budget. This process can be described as follows:

REVISED BUDGET = INITIAL BUDGET + REVIEW PROCESS

As a consequence, initial budget value remains identical to revised budget value if no review process has been approved.

Updating projected cost

As soon as the initial budget has been approved, the project manager can use financial resources, which can then be described as “future costs”. When the project manager starts incurring financial resources, those investments are “incurred costs”. As resources and suppliers deliver and complete the goods and services linked with “incurred costs”, they produce invoices which transfer “incurred costs” to “real costs”. This leads to the following equation:

PROJECTED COSTS = FUTURE COSTS + INCURRED COSTS + REAL COSTS

Controlling unfavourable budgetary discrepancy

The project manager’s main responsibility in terms of project management is to control unfavourable budgetary discrepancy in accordance with the following equation:

DISCREPANCY = REVISED BUDGET - PROJECTED COST

At the very beginning of this article, we stressed the fact that controlling project costs is more difficult than controlling operating costs because of the high volatility of following elements:

- How often and how deep budget has to be revised.

- How future costs may vary as the project is being carried out, which can increase or diminish projected costs.

If project promoters are given further investment resources in order to deliver a higher number and/or a higher quality of deliverables, the project manager does not usually have any control on review processes arising from those extra needs. As a consequence, those budget reviews are not attributable to him/her. However, if the very nature of the deliverables remains unchanged as the project is carried out, he/she has to be careful and to do everything in his power to prevent projected costs from increasing too much.

“Drilling” in order to better control cost

The number of activities and deliverables of a project has a great influence on its possible cost increasing. In order to be able to control costs, one may resort to “ drilling in every activity and deliverable ” in order to separate and protect them.

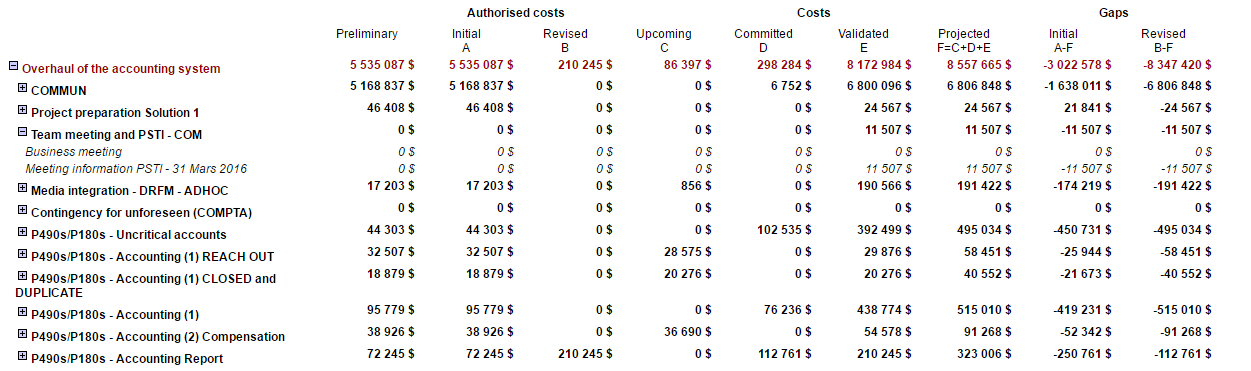

Example of costs-follow up according to deliverables

In order to be able to use this drilling technique, initial budget has to be established putting together activities and deliverables as granular and compiling incurred costs and real costs.