Best business practices for Portfolio Project Management

Project management is nowadays an important element of each company. Because of lacking resources and an increasing number of potential projects that give a potentially substantial added value, managers tend to focus on how these projects could be carried out. Organizations have to look beyond the obligation of managing each project following the three classic constraints, which are:

- Respect of schedules

- Respect of budgets

- Quality of the deliverables

Setting up a relative value for each potential project

Working on projects that may contribute in an optimal way to reaching your strategic, operational and financial objectives is indeed crucial to your organization’s health. A lot of companies focus on a “business” aspect which consists in estimating the potential value of each potential project that is put forward by the unit managers. This creates some issues: When it is time to plan your capital investment programme, the number of potential projects is bigger than what the company could actually carry out.

Prioritizing projects that give a higher relative value

No potential project has an absolute value: it is necessary to compare all potential projects in order to select the ones that have a higher relative value. In order to do so, it is essential not only to focus on how this project may contribute to meeting the company’s objectives, but also to take other aspects into account, such as the following factors:

- Are there constraints related to the organisational capacity?

- Does the potential project depend on other projects?

- What are the potential impacts on the company?

- How risky is the project?

- Is the potential project subject to existing statutory obligation?

Designing transparent investment programmes

“ What you understand well, you enunciate clearly ”. This sentence takes perfect sense when it comes to designing investment programmes that will finance selected projects. In order for the investment programme to separate feasible projects from unfeasible projects, it has to be transparent and faultless. It is necessary to:

- Clearly state the strategic, operational and financial objectives

- Establish a weighting of each objective

- Define performance metric

- Identify sources of funding

- Determine evaluation period of cash flows

- Define financial targets

- Discount rate (in order to calculate NPV)

- Internal rate of return

- Payback period

Managing each project in accordance with the best business practices

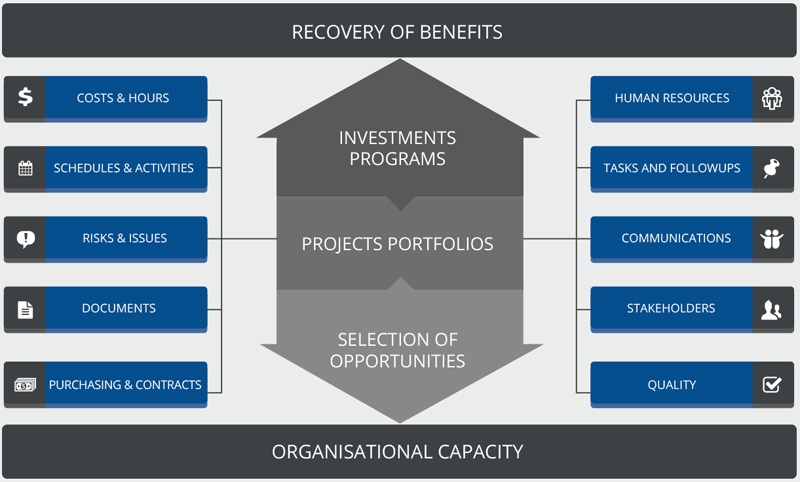

Once the feasibility study has concluded that the project could be implemented, it is of course necessary to carry out this project in accordance with the best business practices, as suggested by the Project Management Institute. Optimum project management relies on using knowledge areas in a pragmatic way as listed in the management device:

- Costs and efforts

- Human resources

- Schedule (Gantt)

- Communication

- Quality of the deliverables

- Project tasks and activities

- Purchase and contract management

- Risks and issues

- Documents

- Stakeholders

Project Portfolio management

Being able to group projects in order to get a real time dashboard is not a luxury. Given the fact that the manager has to deal with a high number of projects from different backgrounds which are dispatched in several units, this is absolutely essential. Dashboards have to be designed in such a way that they provide data to answer the needs of:

- Executive managers

- Project offices managers

- Project managers

- Resources that are allocated to the projects

Architecture of a modular, complete and integrated solution